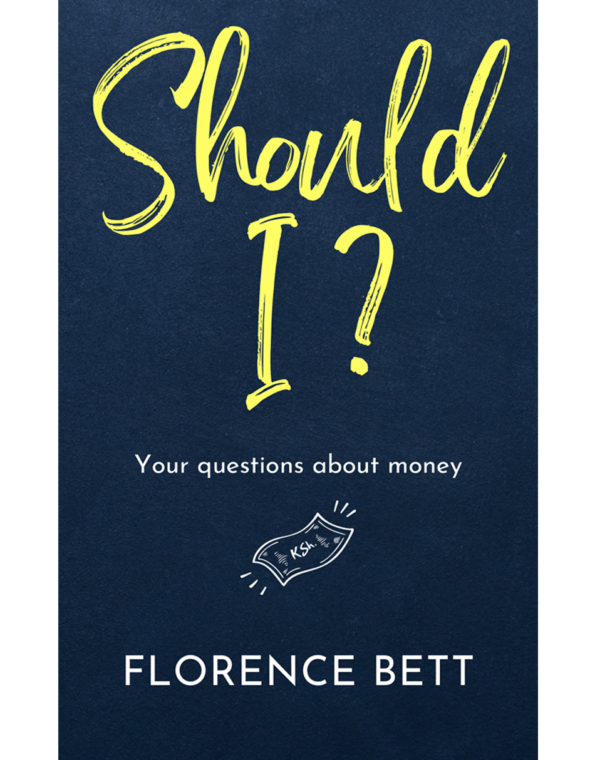

Should I?

Rated 4.97 out of 5 based on 39 customer ratings

(39 customer reviews)KSh 1,199.00

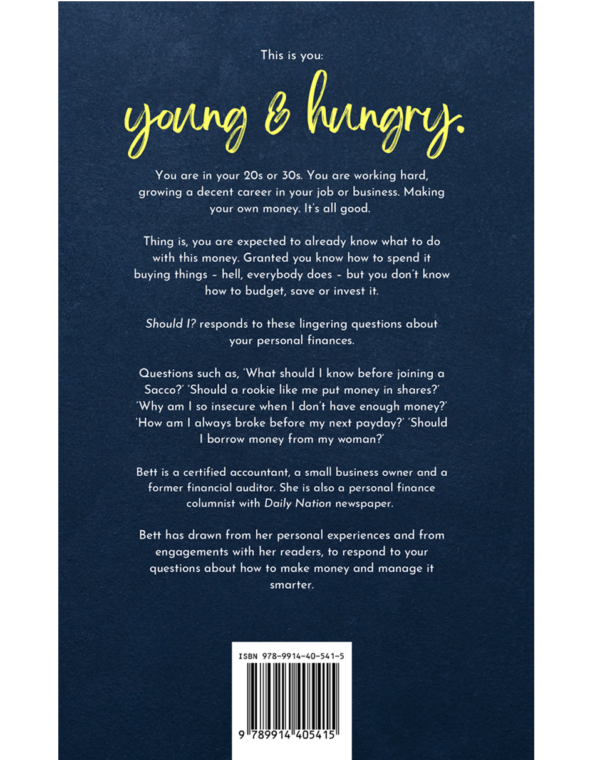

‘Should I?’ responds to those lingering questions about your personal finances. Questions about how to save, budget and invest your money.

... people are viewing this right now

Compare ‘Should I?’ responds to those lingering questions about your personal finances. Questions about how to save, budget and invest your money.

Based on 39 reviews

4.97 Overall

| 97.44% | ||

| 2.56% | ||

| 0% | ||

| 0% | ||

| 0% |

Add a review Cancel reply

39 reviews for Should I?

SKU: SI-01 Category: Books

You may also like…

How Much?

Rated 4.83 out of 5

KSh 1,399.00‘How Much?’ responds to those niggling questions about the life of your money. From the time it gets into your hands to the time it leaves.

@just_ivy_africa (verified owner) –

The answer is yes. Yes, you should read this book. Picked it up casually last night and I could not believe the page-turner it was. Our very own mover Bett managed to marry her impressive financial background with her excellent (witty) descriptive writing skills and educate about money matters in the most riveting way. Her use of personal past experiences and practical number work left me wanting more. Each chapter answers a specific question asked by her Daily Nation column readers and I can say I am impressed. She makes money lessons fun, relatable and dare I say, funny. Ah!

@mark_masai (verified owner) –

This has such relatable contexts and your humour ime-standup kabisa! Will buy this for all the graduates I know and encounter (as is common for graduation gifts). I think on the back of this you could do IG Lives or YouTube convos, Twitter Spaces (before Elon kills it kabisa) with people in the same manner you approach every-day-people questions. I can tell responses take quite a lot of research but something frequent and online that could draw more audiences to your book. Great stuff.’

@lawrebett77 (verified owner) –

When you pen down another one we will definitely get ourselves copies. Your writing is simple and relatable. Once again thanks a lot for coming up with ‘Should I?’ I’m 23 and just got employed last year after my graduation in August. Lucky, right? Money has been my worst headache but now I’m super enlightened thanks to you, Bett.’

@kamathi_reads (verified owner) –

This is such an incredible book. Having read dozens of finance books it’s so refreshing to be able to relate with one specific to our Kenyan financial systems. Eagerly awaiting for your second one.

@waswa_canute (verified owner) –

This book is an investment worth its weight in salt. Thumbs up.

@felix_akuku (verified owner) –

Your brutal honesty in the book is the number one compelling factor to read it. Thanks for immersing us into this gem.

@wamariu (verified owner) –

Hi, thanks for getting back. Really wanted an autographed one but I managed to get one via Rafu Books. I love it and keep up the good work. It has really come in handy and you won’t believe it, just like you said in the book, I will keep referring to it. This one won’t leave my handbag aki.

@julz_akinyi (verified owner) –

I like how other people started making wise money decisions after reading your book. For me, I realised I had a bit of a hoarder and saving money personality. I am now learning to ‘Fulfil myself’ with this money. Spending more on me. It feels great. Thanks for writing this one, can’t wait for the next.’

@becky.njuguna (verified owner) –

I am loving every page of ‘Should I?’ Reading it as I apply. It’s going to be my finances ‘set book’ for life. Thank you for sharing your gift with us!

@mitchie_nimmoh (verified owner) –

I really enjoyed the book. I actually read it in one day. The book was an eye-opener and a guide for me going forward. I loved the Q&A format of answering questions. The practical examples and how you explained them really made it easier to understand money. I have learnt so many things. So many new learnings from budgeting to the transition from being a financial auditor to creative writing space to investments but my biggest lesson is never to lose myself in the pursuit of money.

@ihugomary (verified owner) –

Your book was such an eye-opener. I have forever been afraid of money – mostly spending it. Now I know what to do. Thank you.

@_mr_leroy (verified owner) –

Thank YOU! I wish Kenyan universities and maybe high schools would consider this book in their reading list. If I knew half the things you’ve advised by the time I was 22, I would be very far by now.

@oduor_danton (verified owner) –

The best book I have read this year…‘Should I?’ I love the structure of questions and detailed analysis and answers. Very insightful.

@karen_malakwan (verified owner) –

Finished your book a while back and I absolutely loved it! Especially the humour and how you explained things. Thanks for sharing so many valuable and practical insights. My financial behaviour has positively impacted by your lovely book. I will definitely share it with others who I feel will truly benefit. Your book was in depth and satisfying. I literally didn’t want the book to end. Kongoi mising!

@kerubu_ms (verified owner) –

The combination of humour and number crunching is quite mind-blowing. I bought your book when my finances were a mess and debt was no longer manageable. Now, I’m on a journey towards building my asset portfolio. Your creativity is a gift to us all, Bett.

@spice_discovers (verified owner) –

This book is my daily money Bible, it’s that everyday book. Thank you for crafting such a wonderful piece.

@curious_georgii (verified owner) –

Loads of gems [picked up from your book]. Top two takeaways for me were: 1. Never be afraid to take loans 2. Never borrow money from your girlfriend/wife… It was a really good read. Good job!

@oduor_oruenjo_ (verified owner) –

I find reading easier when travelling. It keeps me awake. I finished my first book of the year, ‘Should I?’ by @_craftit. The book details how you can handle your money better, crunched numbers for better understanding and anecdotes to make you grin. I highly recommend it to my peers at the start of their careers. I hope it opens your eyes the way it did mine.

@yvonestagram (verified owner) –

This has been my June read. I have thoroughly enjoyed every page, every word and man! Florence Bett has a sense of humour. It’s a personal finance book that we can relate to because it’s written by a Kenyan for Kenyans (if I say so myself). I’ve been recommending it to everyone and their neighbours. Get yourself this book (if you haven’t yet) if you want to learn about money. Got mine from Nuria Bookstore. You can also get it from the author herself. Enjoy your read.

@lorraine_o_a (verified owner) –

Well done! I read your book in two days over Christmas! And it opened my eyes to savings, investments etc. Keep at it!

@partelito (verified owner) –

Very informative. The info I wish I had in high school. Great work, Bett.

@kabugzz (verified owner) –

I found your book at TBC Sarit. Even wrote a mini preview on IG. It was a good read. I’m already in my first Sacco, now trying to figure out MMF and Government bonds as a starter pack as an investor. Thanks again for writing so well and passing down the knowledge.

@raves_by_julz (verified owner) –

It’s been a while since I finished a book I picked up. It’s ironic that after a long hiatus, the book that I would finish would be one on personal finance. Probably says more about the book than me. Like all books on money, this one will have you reading with a calculator in one hand and a notebook in the other. Unlike other books on money, you’re allowed to bring your emotions along for the ride on this one. And beautifully Kenyanese! Money in shillings. Kiswahili words here and there. Relatable. Humorous. Tastefully written.

@sharon_jumba (verified owner) –

‘Should I?’ answered questions I didn’t know I had. I recommend it to anyone trying to get a way forward with finances. I’ll be checking out How Much?

Mwende Mati –

⭐⭐⭐⭐⭐/5

I have ALOT to say about this book and the nuggets in it, but I’ve reserved those for my close friends and family who I have tortured with paragraphs from it these past few weeks.

This? This one was like sitting with a financial analyst/personal financial advisor face to face! Who would’ve known that the sad feeling I had about not having money is linked with my financial personality? Who even knew we have financial personalities? Not me.

I’ll say this though: if you are a young adult kindu 20s and 30s, who cares in the least bit about your financial health and freedom; GET ON IT!

@kenyanonfire –

My first personal finance book review.

I bought ‘Should I?’ by @_craftit (Florence Bett) this week. I was excited because it is my first PF book this year and it was by a Kenyan author who understands Kenyan dynamics.

What I love love about it is that you can read any chapter as a standalone. What to start at Chapter 25? Have it 😁

She tackles personal finance questions in such a unique way giving such great examples. I really wish I was 25 reading this book… I would be far! Weuh! I relate with Jane, a lot more with Steve… Want to know what I’m talking about? Get the book 😉 Worth every Shilling. (Came from my miscellaneous budget 😁)

If you are starting out in yours 20s, not sure where to start.. you will love this book. In your 30s and starting to put things in order.. you will love this book. If you don’t understand much about budgeting, Saccos, MMFs etc – definitely worth a read.

It’s also a great gift for your child who is starting college or in high school.

@mainaraphael –

This was one of the best reads. I like how it’s done. You do not have to read chapter after chapter.

I learnt a lot. You took a huge gamble going against traditional writing in terms of language used and how the book was done. Well done, Florence. I have to check out the new book.

Miss Mutisya –

I bought ‘Should I?’ in Nov 2022 and I’ve been recommending it to everyone I meet. Thank you for writing in a fun way and thank you for honouring your gift. I cannot wait to grab your second book. You are such a great writer!!!

Kibathi –

Dear flo 😂I just decided to call you that because I read ‘Should I’ and found out how you despised it 😂.

This is an appreciation post.

I am a 23 year old who just started working. I am an international school teacher. Those words still feel like a dream to be honest ,when I say it out loud.

I’ll try make this really short but I am a blabber mouth and I barely know when to stop.

Growing up I have been afraid of finances. Now I am working and I have to face them head on. Your book ‘Should I’ answered a lot of questions I had that people really never answered adequately for which I am grateful.

I particularly want to talk about how you said you will one day sit your father and hopefully talk about his money history. I read my father that exact statement in your book and it led to a conversation that lasted hours. As his daughter I know understand his mistakes and his best decisions and it has now made me more conscious on how I’ll move money in my career.

Thank you Bett.

Farica –

I read ‘Should I’ and it was really eye opening. As 33 year old banker we assume we know about personal finances until we read books like yours. You are a blessing.

Mukami –

I read your book ‘Should I’ while I was having my hair done one sunny afternoon. It is the most relatable book about money I have ever read. I couldn’t stop talking about it and recommending it to anyone I know.

You are funny, witty and oh so intelligent. My loved one borrowed it and now I have to get myself another copy for reference.

I would love to meet you one day just to pick your brain on matters money.

I can’t wait to dig into this other book already!!

Wanjiru Lorna –

I love love your book 😭😭😭 … like I have been reading books and researching financial stuff but your book made it easy for me to understand ☺️☺️…

Something else is most financial oriented authors write really serious books and you end up giving up but I read should I with 2 days 😂😂😂😂… now I have it in my house like a Bible😂😂😂

Farica –

I read ‘Should I’ and it was really eye opening. As 33-year-old banker we assume we know about personal finances until we read books like yours. You are a blessing.

Ruth Keshi (verified owner) –

I read your book. I loved it. I started with debt management because heh. I’m in debt up to my ass…hehe. I am working on debt consolidation first to increase my take home and to pay the most expensive debt first.

Secondly, I’m looking for ways to make more income. The first thing is to just get a different job. Asking my employer for a raise is ridiculous because I’ve gotten promoted twice over the past two years and my salary doubled. But still it’s not enough I don’t know if being a single mom increases your need for money. I need more money in my pockets. Flowing freely and in abundance.

I loved that your book also talked about the relationship dynamics of money. I now have an idea of when to start having money conversations with my future partner. When to have them. What to expect to do in marriage. And most importantly that I don’t have to expect him to do everything alone. You made me realize how love, money and sex go together. And how financial compatibility is more important than sexual compatibility. The Kenyan context is also soo important.

I’m glad I never wasted my time reading all those westernized money books. Because the culture and the context isn’t African. So, they might not encapsulate black tax, Saccos and two income households.

Peter Kitavi –

My goodness!!

I should have read ‘Should I?’ a long time ago, but nooo…

There’s a voice inside that shouts “Mimi usiniadvice”😂😂

There’s also an irk books on finances leave me with. Something to do with being uncomfortable about opening up. But we’re getting there… progress is being made.

Halfway through the book and let me tell you MAINA!!

I can’t read this book seated because am always on the edge. The conversations are honest, true, vulnerable, and extremely relatable. In fact, I opened the book to a particular chapter, read the title and said “Bett, leave me alone😂😂”

This book isn’t good, it’s great. It should be a handbook as a mandatory unit in campus. So much gem people could learn from this aki😭.

How it’s written is also absolutely fantastic!!

I am a corporate emcee, always working out ways of getting better at public speaking. So how do I read my books? aloud! Taking heed of all punctuation and everything else Mrs. Wiseman taught me (My English teacher).

You know a book hit home when you message the author to say thank you, live long to occupy shelves in my home library. These are books I will want my children’s children to read.

Thank you!

Nick (verified owner) –

This book is such an eye opener to any young person who’s willing to make good financial decisions. Perfect gift to your son, daughter, nephew or niece or just that one friend who you care most.

Highly recommended

Margaret Keyum –

I recently had the pleasure of diving into an amazing book on personal financial management that has not only given me some interesting perspectives but also provided some practical insights for navigating the landscape of personal finance.

The book touches on managing money and the very basics of it which touch on budgeting, prioritizing and being on top of it all. It also touches on money and relationships because life is still happening and our money decisions are affected by relationships. Lastly she touches on the issue of savings and investments and gives a good insight into some of the options within the local set-up which is great because most financial management books i have read have had a western perspective into financial management.

Some of the few lessons i picked:

📒 Goal-Centric Approach: Set money goals that you are working towards and this is guided by your life goals.

📒 Mindful Money Choices :Take time to understand your money personality. You can get insights from reviewing your habits with money, checking your spending and from your budget as well.

📒 Financial harmony in relationships: Be keen to discuss money and find ways to cohesively/collaboratively achieve financial goals especially if you are in a long term relationship (read mostly marriage). It’s 2023, don’t be shy and start early.

📒Set money aside for your tomorrow, it’s December but January is coming, so spend but ensure you set money aside from whatever you make consistently( prov 6:6-9). There are many ways to do this so shop around from Fixed deposit accounts, Money Markets funds etc…find one that works.

📒 Don’t just save, invest the money ..rather, make informed investment decisions. Invest in what you understand and have information about because it is a risk you will be taking.

The list sounds basic and yes the author starts off with the very basics before engaging you deeper in a very conversational style that draws you in. The kind that makes you feel educated but also challenged to learn more but also very helpful. She even talks about the topic most ‘8-5’ employees dare not talk about loudly- Side hustles!

I enjoyed reading the book and would recommend it for anyone who is still learning and discovering more on the topic of money and looking for practical ways to make things work, after-all it all starts with getting the basics right for a good foundation.

The book is ‘Should I’ by Florence Bett-Kinyatti.

Lillian –

What have I learnt so far ?

A plan is like a road map with your final destination in mind and the best way to get there.

Envision your future life and start working towards it now. Remember to also prioritize your well-being, relationships and hobbies amidst busy schedules to achieve a balanced and holistic outcome.

Keep re-evaluating your goals as your social and economic dynamics change to keep the plan relevant.

I would recommend you read Should I ? by Florence Bett-Kinyatti. In my view it is easy to read with relatable examples.

Cherotich –

I did not know that money talks could be mixed with humor! I though money was a boring subject, but Ms. Bett had to go and prove me wrong. And yes, this shall be listed as one of the few times I am glad to be wrong. This book will certainly have you learn, unlearn and definitely relearn.